Bricktown Parking Garage Sales for $17,250,000 - Phillip Mazaheri, CCIM handled both sides of the transaction

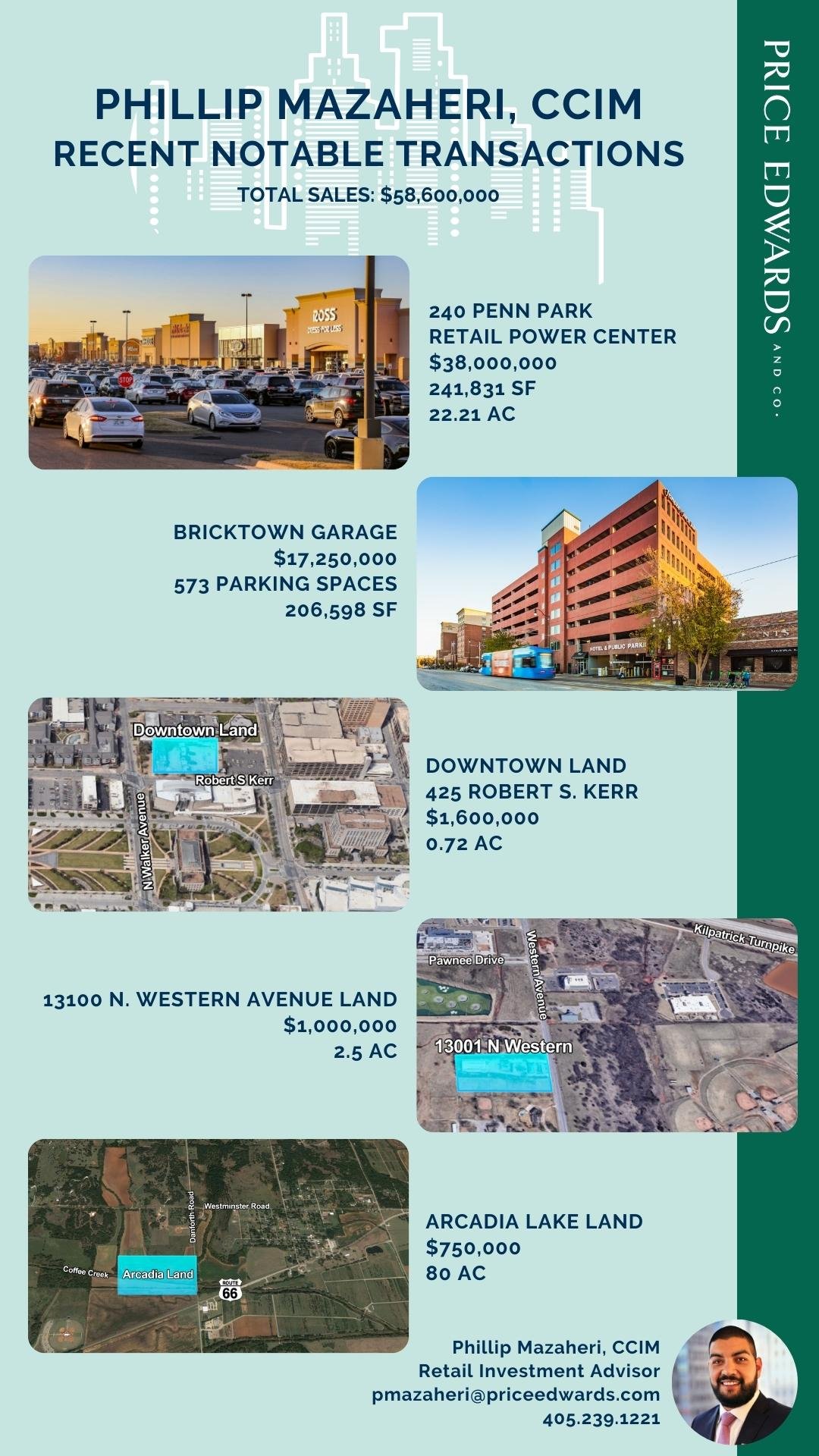

/The Bricktown Parking Garage consists of 206,598 square feet of an 8-story structure of office and parking garage structure located just north of the Chickasaw Bricktown Ballpark. The garage has approximately 537 parking spaces with leases in place with the Hampton Inn & Suites hotel, Hilton Inn, Homewood Suites and Springhill Suites. The Bricktown Garage also has monthly parkers consisting of office tenants in the area and daily parkers for nightlife traffic. The Buyer, Mobile Infrastructure based out of Cincinnati, Ohio purchased the property June 7th, 2022 for $17,250,000. This is MobileIT’s first investment in the Oklahoma City market bringing their portfolio of Garages to 20 with 26 Lots, 16,350 Spaces and $5,834,162 Square Feet in 23 Markets. The Seller, Fred Mazaheri, a local developer with Mazaheri Properties (Bricktown Garage Parking, LLC) purchased the property in 2013 for $9,375,000. Phillip Mazaheri, Retail Investment Advisor with Price Edwards & Company, handled both sides of the transaction.

Phillip Mazaheri, CCIM handles Sale of $5,200,000 Retail Investment Shopping Center in Oklahoma City

/Cornerstone Crossing in Oklahoma City is a 73,791 square foot retail neighborhood strip center situated on 6.15 acres. The property is located on the south west corner of NW 39th Expressway and MacArthur Boulevard nearby Southern Nazarene College. The property was sold at 92% occupancy for $5,200,000 or $70.47/sf with a CAP Rate of 10%. Phillip Mazaheri, CCIM handled the transaction for the Buyer Cornerstone Crossing, LLC initially in 2016 when it was purchased for $3,200,000. Less than four years later with some lease up, Mazaheri handled the Sale to Cornerstone One, LLC, a Buyer out of Kansas City, Missouri.

Phillip Mazaheri, CCIM Sales Moore Retail Investment Center for $6,050,000

/The Exchange on 19th is a 13,375 square foot strip center built in 2016 situated on 1.76 acres. The property is an outparcel for Winco Foods and is located directly across from Super Target, Burlington, Dick’s Sporting Goods and Home Depot in Moore, Oklahoma. The Exchange on 19th was purchased at 100% occupancy with 54% of the tenants being corporately guaranteed, which includes Chipotle, Visionworks and Mercy GoHeath Urgent Care. The property was purchased at a 7.56% CAP rate with the majority of leases being on ten year primary terms. Phillip Mazaheri, CCIM represented the local Buyer Hartford Capital, LLC who paid $6,050,000 to the Seller/Developer Armstrong 19 Moore Development, LLC.

Local Buyer Purchases Moore Strip Center for $4,275,000

/Berkshire Developments, LLC purchased a 7,514 SF strip center in Fritts Farm from Moore Retail Management, LLC. Fritts Farm is a major retail center in Moore, Oklahoma anchored by a Super Target. The outparcel strip center is anchored by corporate leases with Helzberg Diamonds and Pacific Dental. The sales price equated to a 7% capitalization rate with all leases on 10-year primary terms. Phillip Mazaheri, CCIM represented the buyer in the transaction.

Retail Investment Team Announces Sale of $9,600,000 Sale of Casady Square Shopping Center

/The Price Edwards Retail Investment Team is proud to announce the sale of Casady Square in The Village, Oklahoma. GRP Investments Investments, LLC purchased the property from MVP Casady, LLC for $9,600,000. The shopping center consists of 136,772 square feet situated on 8.43 acres of land. Casady sold for $70.19/SF at an 8.51% CAP rate.

Paul Ravencraft, Phillip Mazaheri, CCIM and George Williams, CCIM with Price Edwards Retail Investment Team handled the transaction.

Retail Investment Team Brokers $3,095,000 Sale Of Townesouth Plaza Shopping Center

/The Price Edwards Retail Investment Team is proud to announce the sale of Townesouth Plaza in Oklahoma City, Oklahoma. Kona Capital Investments, LLC purchased the property from Midland Capital, LLC for $3,095,000. The retail restaurant consists of 15,882 square feet situated on 2.18 acres of land.

Paul Ravencraft, Phillip Mazaheri, CCIM and George Williams, CCIM with Price Edwards Retail Investment Team handled the transaction.

Retail Investment Team - JUST LISTED - Casady Square Neighborhood Shopping Center

/Casady Square consist of 136,772 square feet of retail situated on 8.43 acres of land. The tenant mix includes local and national tenants, most being well known local long-term destination shops. Casady Square is currently 85% occupied with notable tenants such as: T-Mobile, Nuvo Home, 1492, Fitness 19, Farmers Insurance, No Regrets and New Leaf Florist. National Retailers in the area include: Walmart Neighborhood Market, Bank of Oklahoma, Walgreens, CVS, Church's Chicken, Arby's and Little Caesars Pizza.

- Sale Price: $9,500,000

- Price / SF: $69.46

- Cap Rate: 8.62%

- NOI: $819,151

- Building Size: 136,772

- Occupancy: 85%

- Lot Size: 8.43 Acres

- Year Built: 1956

- Renovated: 1973

- Market: Oklahoma City

- Submarket: North/The Village

EPIC Lease at 50 Penn - PEC Retail Investment Team Handles Both Sides of the Transaction

/Article via The Journal Record by Molly Fleming

http://journalrecord.com/2018/08/02/an-epic-move-former-itt-tech-space-to-transform-into-charter-school-location/

OKLAHOMA CITY – Posters from ITT Tech are peeling off the walls at the school’s former space in 50 Penn Place. The cabinets and desks are still in place. Framed posters feature student testimonials about how the school changed people’s lives.

The space has been vacant since September 2016, when ITT Tech abruptly closed all of its campuses. People grabbed their personal belongings and left.

At 50 Penn Place, 1900 Northwest Expressway, the school occupied space on the north and south sides of the third floor, totaling about 19,000 square feet.

A couple of years ago, Epic Charter Schools had looked at combining its Oklahoma City campuses under one roof and considered 50 Penn Place. But they passed, continuing to operate and grow.

Now, the online-based charter school has reached capacity at its three buildings in the city’s northwest sector. It needs more space, so the school is leasing all of the former ITT space. Staff members will start moving into the space in about 60 days, said Ben Harris, Epic’s co-founder.

Price Edwards & Co. Retail Investment Team broker George Williams completed the transaction. The center and tower are owned by In-Rel Properties, based in Florida.

By 2020, the school will move into an additional 20,000 square feet on 50 Penn’s third floor. This will make Epic’s Oklahoma City square footage 80,000 square feet, with its three buildings and 50 Penn Place. Harris said before the move in 2020, the school will evaluate whether it will keep its three old buildings or move everyone to 50 Penn.

Harris said it is appropriate that the school is moving back into a mall since it once had space in North Park Mall.

Moving into 50 Penn came with several advantages, said David Chaney, school co-founder and superintendent. It offered plentiful parking, which will be helpful for employees, students and parents.

Epic considers itself a blended learning school. While some activity is done online, students still have to come to the buildings to take tests, or they can meet with teachers.

The location was also an asset, Chaney said. Epic’s Oklahoma City campus is in its second year of operating a learning center for elementary-school-aged children. Parents can drop their students off at the school and not have to pick them up until 6 p.m. Being on Northwest Expressway and still in the northwest sector will be helpful to parents, he said.

Since Epic is occupying a former school, it will be able to save on furniture costs.

“Everything is in great shape,” Harris said.

The ITT space offers a variety of room sizes, which will give Epic enough areas for student testing and teacher meetings. The school gives the required state tests, as well as its own quarterly benchmark assessments.

When Epic is ready to move into the other 20,000 square feet, the mall space will be redesigned. The existing Urban Market restaurant will remain.

Epic has spoken with HSE architecture firm and Smith & Pickel construction about updating the space. The renovation will start in spring 2019.

With Epic in 50 Penn, the retail center has 75 percent occupancy. The office tower is 90 percent occupied.

Williams said it made sense to go after a nontraditional retail tenant because retail hasn’t been successful at 50 Penn in several years. There’s still 30,000 square feet to fill at 50 Penn, Williams said.

“When Epic came along, it was a perfect for what the landlord wanted, and what Epic wanted, too,” he said.

Harris said the 50 Penn staple Full Circle Bookstore is a great amenity to the new space as well, and can also be a place where students meet with teachers.

“We feel like 50 Penn is a good place for our employees, too,” Chaney said.

Riverwalk Centre Sold for $5,150,000 - Retail Investment Team Handled Both Sides of the Transaction

/Article via The Journal Record by Molly Fleming - http://journalrecord.com/2018/08/03/riverwalk-centre-sold-for-5-15-million/

MOORE – A shopping center in a popular area has traded hands and will soon have a new tenant.

Dallas-area-based Riverwalk Centre LLC, led by Tommy Dreiling and his business partner Todd Rouse, purchased the 78,127-square-foot Riverwalk Centre, 2712 S. Telephone Rd. in Moore, for $5.15 million, or $65 per square foot.

This is the group’s first purchase in Oklahoma, though Dreiling has been in real estate development for more than 20 years.

Price Edwards & Co.’s Retail Investment Team handled the transaction. Paul Ravencraft, Phillip Mazaheri, and George Williams make up the team.

Ravencraft said the center had gone through a foreclosure. Price Edwards listed it in September 2017, and the sale closed July 12. He said the team received about 10 offers on the property, with people interested inside and outside the state.

The center is anchored by the vacant 60,000-square-foot Gordmans space. Gordmans declared bankruptcy in March 2017 and closed all its stores. Having this large space could have made the sale a challenge, Ravencraft said.

“The market for a buyer with a 60,000-square-foot anchor space was pretty tough,” he said. “The difficult thing is that just about every big-box tenant was already there. There wasn’t a lot to pick from.”

But there’s not an Urban Air multi-entertainment center, which is what Dreiling will bring to the center. He’s a franchisee for the concept. He’ll be putting the Urban Air into the former Gordmans space. It will be one of the largest Urban Airs in the country, he said.

Since Dreiling had the entertainment venue in his pocket, buying the center was a win-win. He said the Urban Air will offer more than trampolines. It will have go-carts, laser tag, bumper cars, a sky ride where children can get harnessed from the ceiling, and warrior courses, like seen on the television show American Ninja Warrior.

“This is a trampoline park on steroids,” he said.

Dreiling said he expects to revitalize the entire center, especially when the anchor Urban Air opens. He said he hopes to have it open by Thanksgiving, but realistically it will be by year’s end.

He said the Moore area is attractive because of the growth in the school district and the surrounding homes’ median incomes.

“We like the possibilities,” he said. “We feel like the Moore City Council and Moore as a whole are very economic-development friendly. They have been one of the most helpful cities so far. These guys really want us there.”

Dreiling is planning to put another Urban Air in Oklahoma City and has the franchise rights to a site in Columbia, South Carolina, and Southern California.

Retail Investment Team Represents Local Investor in Trophy Power Center Sale for $43,500,000

/Quail Springs Marketplace

SW/Corner of Memorial and Penn

Allen Gann, a local energy and real estate investor, acquired Quail Springs Market Place located at the southwest corner of Memorial Road and Pennsylvania Avenue. Located in the heart of Oklahoma City’s leading retail corridor, the 293,788 square foot power center situated on 28.53 acres sold for $43,500,000 or $148 per square foot. A number of institutional investors are leaving the Oklahoma City retail market which is creating opportunities for local investors to buy trophy properties. Quail Springs Marketplace is a prime example, last selling for $47.6 million in 2005. The property is home to a number of leading retailers, both national and local, including Ross, Michaels, Ulta, Golf Galaxy, Akins and Metro Shoe Warehouse among others. The Memorial Road Corridor is the bell cow of Oklahoma City retail; it leads the market both in the total retail square footage and in retail demand. Price Edwards & Company Retail Investment Team consisting of Paul Ravencraft, Phillip Mazaheri and George Williams represented buyer in the transaction. Chicago Title handled the closing and financing was provided by Midfirst Bank.

Retail Investment Team - JUST LISTED - Edmond Shopping Center

/Berkshire Plaza is anchored by Office Depot. The center is located near several national tenants including Home Depot, Starbucks, Academy Outdoor Sports, Verizon and Petsmart. Office Depot recently renewed their lease for 10 additional year until 2025.

- Sale Price: Subject To Offer

- NOI: $314,151

- Lot Size: 3.07 Acres

- Year Built: 2000

- Building Size: 35,612 SF

- Zoning: Commercial

- Submarket: Edmond

- Located in the Heart of Edmond

- Anchored by Office Depot

- High traffic intersection

- Located in Oklahoma's most desirable market, Edmond

- Two miles from Interstate 35

- University of Central Oklahoma and Oklahoma Christian University nearby

Retail Investment Team - JUST LISTED - Crossroads Mall for $8,273,350

/Price Edwards & Company is pleased to announce they have been retained by CRM Properties as the Exclusive Broker in the sale of Crossroads Mall (“the Property”) located in Oklahoma City, Oklahoma. The Property is a 800,070 square foot mall located at the northeast corner of Interstate 35 and Interstate 240. Crossroads Mall is the largest mall in Oklahoma and can be purchased at far below replacement cost.

Crossroads Mall offers an investor or developer the opportunity to own property at arguably the best intersection in the state of Oklahoma. At the intersection of I-240 & I-40 the 63.31 acre site is ideal for several uses. The site is zoned I-2 (Moderate Industrial) and could be used for anything from Industrial Distribution to Retail. With the flexibility to use a portion or all of the existing structure, an investor will be able to have some infrastructure in place. To offset a small portion of the carrying cost of the vacant mall, the owner will receive income from the outer ring tenants. By closing the mall, all types of possibilities are now obtainable for this extraordinary property.

Conversion – the premium location and sheer size of the project provide the opportunity to be creative through re-design and re-development as an education hub, industrial distribution center.

Full Mixed Use – 63 acres and great visibility provide the footprint and infrastructure for a full mixed-use project that could include retail, office, garden office, residential, and flex space.

Industrial – the Property is zoned moderate industrial and, with the adjacent rail service, interstate access, and the availability of heavy infrastructure, is a prime distribution/warehouse site.

HOW DOES THE NEW TAX BILL TAX IMPACT COMMERCIAL REAL ESTATE?

/The Tax Cut and Jobs Act that recently passed is the most sweeping tax reform since the Reagan administration. The legislation will impact everyone, some will reap more benefits than others.

On a range of points, commercial real estate will see positive benefits under the new law. Let’s review a few of the changes that have the potential to fuel commercial real estate.

Pass-Through Entities

Pass-through entities such as partnerships and limited liability companies are set to benefit significantly from the new law. These are companies that do not pay direct corporate tax, but instead “pass through” their gains and losses to the individual members of the company or partnership. Under the new law, investors in pass-through entities will benefit from a new 20% deduction.

Real estate investment is almost always conducted through such entities. Owners of pass-through entities may be eligible to claim a 20 percent deduction for business-related income. For example, if an LLP owns a commercial building that provides $200,000 in annual income to its investor partners, those individual investors could avoid paying taxes on $40,000 of that income if they are eligible for the full 20 percent deduction.

1031 Exchanges

1031 exchanges allow you to exchange like-kind property and roll your gain forward without having to pay tax. This provision remains mostly unchanged except for one modification.

The new rules modified 1031 exchanges to include only real property. That exclusion will have a negative tax impact on real estate assets that also contain a high amount of personal property, such as restaurants that have significant value tied up in the furniture, fixtures, and equipment. Previously, those companies were able to exchange the full amount.

Tax Brackets

The tax plan lowers most individual tax rates and increases the standard deduction.

In 2017, for a married couple the brackets were:

-10% (taxable income up to $18,650)

-15% ($18,650 to $75,900)

-25% ($75,900 to $153,100)

-28% ($153,100 to $233,350)

-33% ($233,350 to $416,700)

-35% ($416,700 to $470,700)

-39.6% (taxable income over $470,700)

Under the new plan they would be:

-10% (taxable income up to $19,050)

-12% ($19,050 to $77,400)

-22% ($77,400 to $165,000)

-24% ($165,000 to $315,000)

-32% ($315,000 to $400,000)

-35% ($400,000 to $600,000)

-37% (taxable income over $600,000)

Overall many of the provisions passed will have a positive impact on tax savings for investors, allowing them to keep more of their earned income. Another factor that could impact real estate includes the “tax holiday” that allows corporations to repatriate some of the trillions of dollars that are held outside the U.S. with a significantly smaller tax penalty. This may very well drive demand in many areas if that cash is invested back into the economy as expected. Lastly, most Americans should see some tax savings from the above rate reductions, 401k increases, and hopefully higher wages and bonuses. This means more money for retail goods and services that will drive up consumer spending and boost the economy.

With any legislation this size, it will take time to determine the net effect but initial analysis appears promising for economic and job growth that will, in turn, drive demand for commercial real estate.

Paul Ravencraft, George Williams CCIM, Phillip Mazaheri, CCIM

Retail Investment Team

Retail Investment Team Brokers $1,300,000 Sale of the Former Old Chicago South

/2125 SW 74th, Oklahoma City, OK

The Price Edwards Retail Investment Team is proud to announce the sale of the Former Old Chicago South in Oklahoma City, Oklahoma. Xiao Yang Investment, Inc. purchased the property from Pearl's South, LLC for $1,300,000. The retail restaurant consists of 5,517 square feet situated on .83 acre of land.

Paul Ravencraft, Phillip Mazaheri, CCIM and George Williams, CCIM with Price Edwards Retail Investment Team handled the transaction.

Retail Investment Team Brokers $2,000,000 Investment Sale in Oklahoma City

/The Price Edwards Retail Investment Team is proud to announce the sale of Ethan Allen in Oklahoma City, Oklahoma. Sunrise Development, LLC purchased the property from Castleberry Inc. for $2,000,000. The retail investment was 13,136 square feet, sold at 100% occupancy.

Paul Ravencraft, Phillip Mazaheri, CCIM and George Williams, CCIM with Price Edwards Retail Investment Team handled both sides of the transaction.

Retail Investment Team Brokers Sale of Former Joe's Crab Shack for $1,655,000

/The Price Edwards Retail Investment Team is proud to announce the sale of the former Joe's Crab Shack in Oklahoma City, Oklahoma. Western Charm, LLC purchased the property from Roger Boyvey, an out of state investor, for $1,655,000. The property consist of 8,489 square feet of retail situated on 2.91 acres of land.

Paul Ravencraft, Phillip Mazaheri, CCIM and George Williams, CCIM with Price Edwards Retail Investment Team handled both sides of the transaction.

Retail Investment Team Lists Bank Owned Shopping Center in Moore, Oklahoma

/Riverwalk Centre - Moore, Oklahoma

2712 S. Telephone Road, Moore, OK

Property Website

- Sale Price: Subject To Offer

- Financials: Avaliable Upon Request

- Lot Size: 8.56 Acres

- Year Built: 2004

- Building Size: 78,127

- Market: Oklahoma City Metro

- Submarket: Moore

- Traffic Count: 109,400

Riverwalk Centre is a Community Shopping Center consisting of 78,127 square feet of retail with mixed small shop and big box stores. The property has major upside potential when leased-up with 13.59% of the property being occupied. Riverwalk is currently bank-owned with the property being marketed by The Retail Investment Team.

Retail Investment Team Lists Former Old Chicago in South OKC

/Former Old Chicago South

2125 S.W. 74th Street, Oklahoma City, OK

Property Website

- Asking Price: $1,400,000

- Price Per SF: $253.76

- Lot size: .83 Acres

- Renovated: 2008

- Building Size: 5,517 SF

- Submarket: South Oklahoma City

The Former Old Chicago is located at 2125 S.W. 74th Street in Oklahoma City, Oklahoma. The property is situated on .8292 acres of land with 5,517 square feet. The property could have drive-thru access or be redeveloped as it currently sits, a sit down restaurant. Traffic counts on Interstate 240 boast over 92,000 cars per day with 23,197 cpd on Penn Ave.

Retail Investment Team - JUST LISTED Former Joe's Crab Shack Restaurant in Oklahoma City

/Former Joe's Crab Shack Now For Sale

5940 Northwest Expy, Oklahoma City, OK

Property Website

- Asking Price: $2,000,000

- Price Per SF/Land: $15.78/SF

- Lot size: 2.91 Acres

- Renovated: 1997

- Building Size: 8,489 SF

- Submarket: Northwest Oklahoma City

The Former Joe's Crab Shack is located just off the south west corner of N.W. Expressway and MacArthur Blvd. The property is situated on 2.91 acres with 2.07 acres being usable. With multiple national retailers in the area, the property could be remodeled for restaurant use or a re-development opportunity. The restaurant consists of 8,489 square feet not including the patio with pond views on the west of the property. The N.W. Expressway is three lanes west and three lanes east, with a total of 46,332 cars per day.